OAN’s Brooke Mallory

5:30 PM – Monday, July 17, 2023

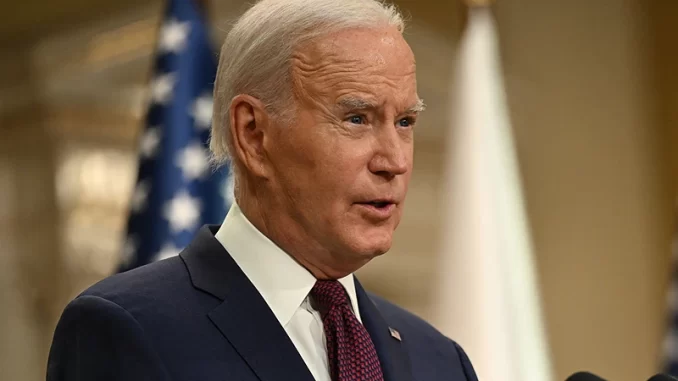

According to the Penn Wharton Budget Model, President Joe Biden’s new income-driven repayment plan for student loans will cost $475 billion over the next ten years, which is tens of billions more than a previous proposal that the Supreme Court rejected last month.

Advertisement

According to the Penn model, taxpayers will incur $200 billion in expenditures as a result of payment cutbacks under the president’s “Saving on A Valuable Education” (SAVE) plan since over half of the $1.64 trillion in outstanding loans would be paid.

Payment reductions under the plan for $1.03 trillion in new student loans over the next decade will cost taxpayers an additional $275 billion.

According to the model’s estimate range, the cost of the Income-Driven Repayment (IDR) plan could be as low as $390.9 billion or soar as high as $558.8 billion.

“Due to the increased generosity of the newly proposed IDR plan, future student borrowers have the incentive to increase their federal student loan borrowing,” said Penn Wharton junior economist Penlei Chen.

The president’s SAVE proposal is reportedly set to go into effect on July 1st, 2024, and would purportedly reduce monthly income-based student loan payments in half, eliminate monthly payments for minimum-wage earners, and erase all outstanding debt after ten years of payments for student borrowers who borrowed less than $12,000.

According to the Biden administration, most community college students would not have to repay any debt under the plan.

“Make no mistake, Biden’s newest student loan scheme only transfers the burden from those who willingly took out loans to Americans who never attended college or who already fulfilled their commitment to pay off their loans,” said Sen. Bill Cassidy (R-La.), who chairs the Senate Health, Education, Labor, and Pensions Committee, calling the repayment “irresponsible” and “unfair.”

The senator’s office stated that households earning more than $250,000 per year may be eligible for “some” government help if they file their taxes separately. They also cited a March Congressional Budget Office assessment that understated Biden’s loan plan, putting the public cost previously at $276 billion.

Education Secretary Miguel Cardona also stated on Friday that his agency will erase $39 billion in federal student loans for 804,000 students who had been paying them for 20 to 25 years, depending on when they began the repayment process.

The Supreme Court ruled 6-3 on June 30th that it was unlawful to write off the debt without legislative consent, overturning Biden’s plan to erase up to $430 billion in loans for up to 43 million borrowers.

That plan relied on a 2003 statute intended to waive loans for veterans of the Iraq and Afghanistan conflicts, claiming that the financial hardship caused by the COVID-19 era constituted a similar national emergency.

Many Americans have voiced their frustrations with Biden and his administration’s consistent efforts to shift the financial burdens of those who freely chose to take out loans and attend university to taxpayers who chose to go to trade school or who were unable to attend college due to financial constraints.

Stay informed! Receive breaking news blasts directly to your inbox for free. Subscribe here. https://www.oann.com/alerts