President Joe Biden’s latest budget proposes the federal government spend trillions more than it will take in, increasing the already unsustainable federal debt by $17 trillion over the next 10 years.

But these 13- and 14-figure dollar amounts have little meaning for ordinary Americans whose income, spending, and debt are typically in the five- and six-figure amounts. Translating Biden’s budget down to the household level provides a better perspective—albeit a grim one.

His proposal has the government spending $7.3 trillion in 2025, rising to $10.3 trillion in 2034, with the federal debt climbing from $37 trillion to $54 trillion, even after accounting for $1.4 trillion in tax increases on the “wealthy Americans and big corporations.”

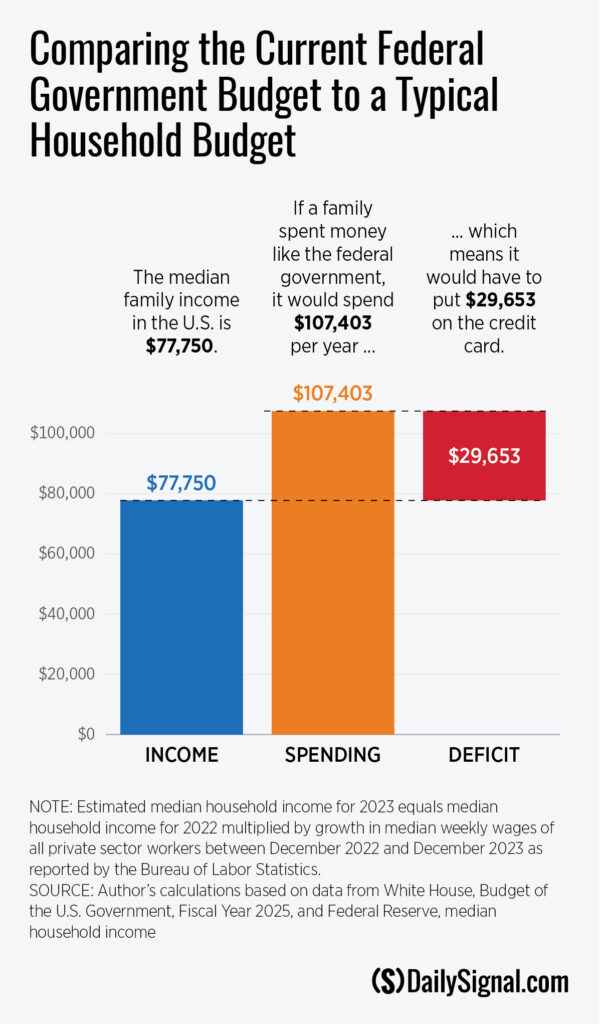

To break this down to the household level, we begin by looking at the median household income, which was an estimated $77,750 in 2023. (Note: The author’s estimate is based on 2022 median household income, increased by median earnings growth in 2023). If the median household budgeted like the federal government, they would have spent over $107,000 in 2023 and taken on nearly $30,000 in new debt, increasing their total debt to about $579,000.

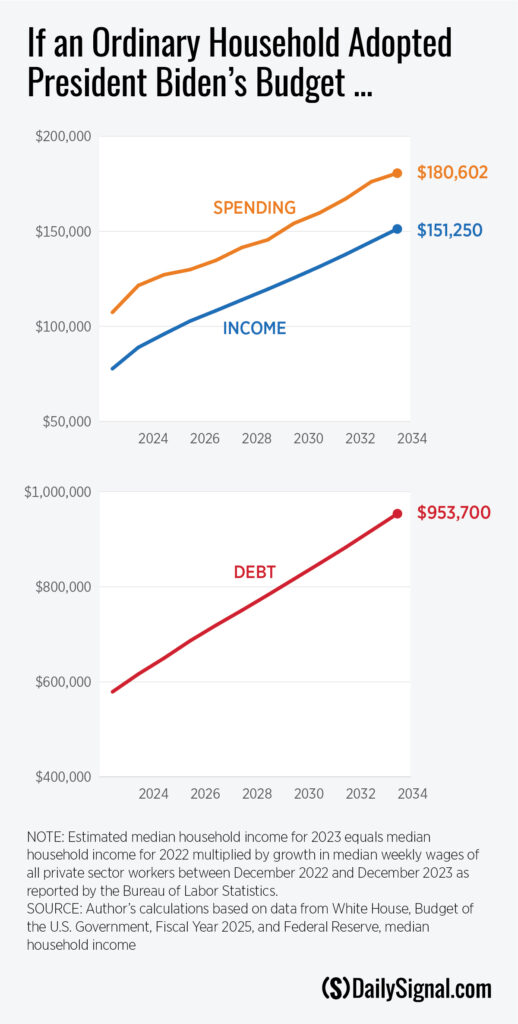

Under the new Biden budget, if household spending and debt grew at the same rate as the federal government’s spending and debt, the average household would spend $348,000 more than it earns over the next 10 years, and total household debt would rise to $954,000. With the median home price equaling $417,700, that debt is equivalent to having 2.5 mortgages.

But the trajectory of this bleak and unsustainable family budget could actually turn out far worse. The president’s budget assumes that tax revenues will increase 70% over the coming decade. For the median household, that would mean a big jump from the current $77,750 annual household income to $151,000 by 2034. Yet over the past three decades, household incomes have averaged half that growth, at 35%. If household incomes were to rise less than projected, household debt would climb even higher. That same calculus applies to the federal government.

While the federal government has a greater ability than households to increase its income in the short run—because Congress can pass laws to take more money from taxpayers—higher taxes lead to a smaller economy, which ultimately makes maintaining higher government revenues even more difficult and damaging to ordinary Americans’ incomes and well-being.

It’s important to note that Biden’s budget does nothing to address the depletion of Social Security’s trust fund, which will result in 23% in benefit cuts—a loss of $5,300 for an average retiree—for all Social Security recipients beginning in 2033. Translated to the typical household budget, that’s like draining all retirement savings accounts on top of accumulating $348,000 in new debt, while relying on one’s children to provide for oneself in retirement.

Without including any specific Social Security proposals, Biden’s budget messaging says that he is committed to working with Congress to protect and strengthen Social Security by asking the highest-income Americans to “pay their fair share.”

The problem with that “commitment” is that the one Social Security proposal that was designed to align with Biden’s promises—the Social Security 2100: A Sacred Trust Act—relies on budget gimmicks, including 75 years of tax increases but only 10 years of benefit increases. If the benefit increases in that proposal were made permanent, it would actually hasten Social Security’s insolvency by two years and increase its shortfalls by 21%.

The only current proposal that would make Social Security solvent (at least before accounting for the negative economic impacts) would expand the program and hike taxes by $34 trillion over the next 75 years. That plan—the Social Security Expansion Act—includes a new 16.2% tax on small business owners and top federal tax rates of 51.8% on wages and 36.2% on long-term capital gains and dividends, up from the current 40.2% and 23.8%, respectively.

Combined with state taxes, the top rates would equal 65.6% on wages and 51% on long-term capital gains and dividends. And those tax rates don’t include the tax hikes on the wealthy and high earners that Biden proposed in his budget.

Simply put, it is impossible to pay for current spending—and even less so, Biden’s proposed spending increases—by taxing the rich.

If the president—or any lawmaker—wants to relate to and help ordinary Americans, he should start by adhering to the same budget limitations faced by ordinary Americans. No responsible individual or family would consistently spend more than they earn, nor would they spend money in ways that prioritize their own consumption over the future well-being of their children and grandchildren.

A responsible federal budget would address the major drivers of our federal debt by proposing common-sense reforms to major entitlements like Social Security and Medicare, and by reorienting federal spending to only inherently federal government purposes. And just like a responsible household budget helps families pursue their goals, a responsible federal budget would help expand opportunities and increase the well-being of younger and future generations.

Have an opinion about this article? To sound off, please email letters@DailySignal.com, and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the URL or headline of the article plus your name and town and/or state.