Two competing proposals in Congress address Social Security provisions—the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO)—that affect workers who have worked in jobs that were exempt from Social Security.

One proposal would revert to a deeply flawed benefit system at a cost of $183 billion while hastening Social Security’s insolvency by more than a year. The other would provide a long-term correction to the WEP at no long-term cost to Social Security.

>>>Read the full report: Congress Should Pass a Fair Correction to Social Security’s Windfall Elimination Provision and Government Pension Offset

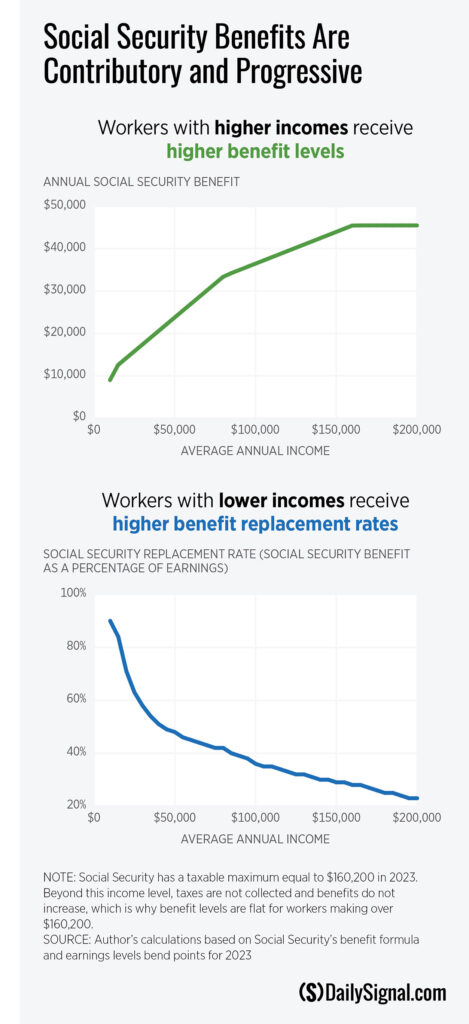

The need for a fix goes all the way back to Social Security’s inception in the 1930s. Social Security was designed to be contributory and progressive. That means that the more people earn (and thus the more they have to pay in Social Security taxes), the more they receive in benefits, and the more people earn, the lower their benefit will be as a percentage of their prior earnings.

While nearly all workers and employers must pay into Social Security, some jobs—namely, state and local government jobs—were, and may still be, exempt.

Because Social Security benefits are based on average earnings over 35 years, and years spent in exempt or non-covered employment are counted as zero earnings, some workers were treated like low-income earners and received proportionally higher Social Security benefits—so-called “windfall benefits”—despite having higher lifetime earnings.

Congress corrected those windfall benefits with the Windfall Elimination Provision (WEP) in 1983. But lacking sufficient data to design an accurate correction, the WEP resulted in some individuals receiving smaller—and some people, larger—Social Security benefits than intended.

An earlier and similarly imperfect remedy, the Government Pension Offset (GPO) of 1977, addressed windfall spousal benefits. Those windfalls were occurring for workers who spent most or all of their careers in jobs exempt from Social Security and qualified for spousal benefits intended for spouses—primarily stay-at-home mothers—who did not perform significant work in the formal labor market.

Sufficient data now exists to provide a fair correction to the WEP and to the GPO, but Congress has yet to pass one.

Two proposals in Congress would address the problem.

The first proposal, the Social Security Fairness Act of 2023, would eliminate the WEP and GPO entirely, reinstating unintended windfall benefits from more than four decades ago. This would result in middle- and high-income earners being treated like lower-income earners.

For example: Consider a hypothetical Rick, who earned $150,000 per year throughout his entire career, but he only paid Social Security taxes for 12 of those years and was exempt from them for 23 years. Eliminating the WEP would mean Rick is treated like someone who had average earnings of a little more than $51,000 per year, and would receive a windfall benefit of about $9,000 per year more than if his benefit were based on his earnings only when he was contributing to (and not exempt from) Social Security.

Consequently, the Social Security Fairness Act would take an extra $183 billion from Social Security’s waning trust fund over the next 10 years, causing the program to become insolvent more than a year earlier than currently projected, in 2032 instead of in 2033.

When Social Security becomes insolvent, all beneficiaries will be subject to across-the-board benefit cuts averaging more than $5,000 per year.

The Equal Treatment of Public Servants Act of 2023, on the other hand, provides a long-term remedy to the WEP with modest short-term (and zero long-term) costs.

Policymakers should build on the Equal Treatment for Public Servants Act by expediting the shift to accurate benefit calculations and should also implement a similar proportional remedy for the GPO.

This would preserve Social Security’s progressive and contributory intent while also improving on the program’s shortfalls. To help to gain bipartisan support, policymakers could consider incorporating a Social Security credit for years spent out of the formal workforce while raising children.

In addition to correcting Social Security’s WEP and GPO, policymakers must fix the program as a whole. Social Security will be insolvent within a decade. Anyone belonging to Generation X, millennials, Generation Z and younger won’t receive a single full benefit.

Social Security’s growing unfunded obligations already total $172,000 for every household in America. And raising taxes by enough to simply maintain current benefits would require an extra $2,600 to $3,400 in taxes every year from the median-income household.

Preserving Social Security will require difficult decisions. The Heritage Foundation’s proposal would focus on restoring Social Security’s original purpose, improving benefits for those most in need, and providing an opportunity for individuals to build wealth within the system. (The Daily Signal is the news outlet of The Heritage Foundation.)

Those reforms would make most people—and the entire economy—better off.

Have an opinion about this article? To sound off, please email letters@DailySignal.com, and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the URL or headline of the article plus your name and town and/or state.