OAN Geraldyn Berry

UPDATED 1:33 PM – Monday, March 13, 2023

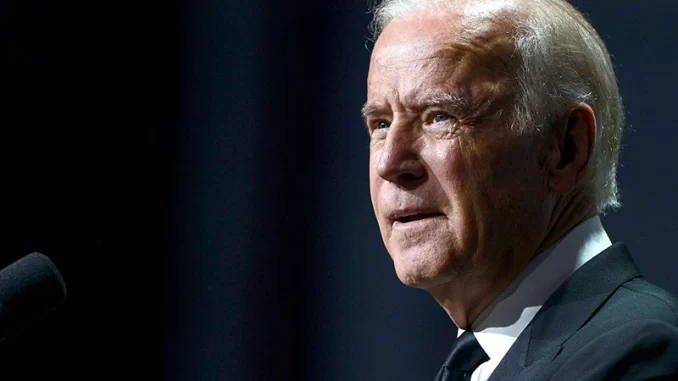

President Joe Biden assured Americans on Monday that the country’s financial institutions were secure. Meanwhile, he stated that his administration’s emergency plan is prepared to cover the failure of two banks.

“Americans can have confidence that the banking system is safe,” Biden said. “Your deposits will be there when you need them. Small businesses across the country that deposit accounts at these banks can breathe easier knowing they’ll be able to pay their workers and pay their bills, and their hard-working employees can breathe easier as well.”

This statement comes as two banks have shut down.

Following a surge of cash withdrawals from depositors last week due to worries over its balance sheet, the FDIC was named receiver after California regulators closed Silicon Valley Bank on Friday. It was reported that there was more than $2 billion loss, which marked SVB’s collapse as the second largest bank failure in United States history.

New York-based Signature Bank had also failed. At more than $110 billion in assets, Signature Bank is the third-largest bank failure in U.S. history.

The president spoke from the White House and pledged to hold individuals accountable and pushed for tighter control and regulation of larger banks. In addition, he guaranteed that “no losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

In his remarks, Biden mentioned investors in the bank and said that management of the banks should be fired. He was referring to the Federal Deposit Insurance Corp., the agency responsible for ensuring the stability of the banking system.

“They knowingly took a risk, and when the risk didn’t pay off, investors lose their money. That’s how capitalism works,” Biden said.

On Sunday, the Treasury Department, Federal Reserve and FDIC said that all Silicon Valley Bank clients would be protected and able to access their money.

According to the plan, depositors at Silicon Valley Bank and Signature Bank will have access to their funds starting on Monday, even if their holdings are greater than the $250,000 insurance cap.

“This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth,” the agencies said in a joint statement.

Following his remarks about the recent event, the POTUS will be traveling to San Diego, California, for meetings with Australian Prime Minister Anthony Albanese and British Prime Minister Rishi Sunak.

Be the first to comment